We owe it to our veterans to work toward oil independence

This is the week we show our respect and gratitude to veterans for their service to our country. But that sentiment doesn’t have to be reserved just for Veterans Day.

This is the week we show our respect and gratitude to veterans for their service to our country. But that sentiment doesn’t have to be reserved just for Veterans Day.

Over the last month, the following incidents have taken place in the Middle East:

Many American think all this violence started with the U.S. invasion of Iraq in 2003. In fact, it’s been going on since the 7th century. The original argument began with the succession to Muhammad’s leadership when he died in 632 A.D. There were two claimants to his legacy. The first was the Umayyad Caliph, made up of the followers of Muhammad’s entourage in Medina and Baghdad. The second was Hussein, the grandson of Muhammad, who claimed to be his legitimate heir.

In 680, Caliph Muawiyah I of the Umayyad died and tried to pass his rule on to his son, Yazid, despite a written agreement with Hussein to honor his claim to the throne. Yazid demanded that Hussein acknowledge his rulership, and Hussein refused. Instead, he mounted an army and headed toward Baghdad, where Yazid was seated. During the march, however, Hussein’s supporters dwindled, and when he arrived at Karbala, about 50 miles south of Baghdad, he only had 75 followers left. There he was met by an army of 1,000 men sent forth from Baghdad by Yazid.

Hussein deliberated for a week before deciding once again to refuse Yazid’s leadership and join him in battle. By this time, Yazid’s army had swelled to 6,000. Hussein went to battle with about 75. Hussein’s army was slaughtered, and he was himself beheaded and his head sent to Baghdad. Hussein’s followers set up a rival caliphate in Medina, however, and the schism between the Sunni Umayyad Empire and the rival Shi’ites began and continues to this day.

The Shi’ia, who eventually established their dominion in Persia (Iran), still celebrate the holiday of Ashura, in which they flagellate themselves because they were not there to help Hussein at the Battle of Karbala. As one scholar has put it, the Shi’ia are “born martyrs.” Iran is the one country you can imagine starting a nuclear war, even if it meant nuclear suicide.

All this would be only of antiquarian interest if it were not that more than half the world’s oil comes from the Persian Gulf. And all that oil is continually riding on the chance that the two sides will not disrupt the flow of oil — or destroy whole oil fields — in their endless, ongoing battles. The stakes are only getting higher. Last week, ISIS rebels in the Sinai Peninsula claimed to have hit an Egyptian naval vessel with a guided missile offshore in the Mediterranean. How long will it be before rival factions are firing guided missiles at oil tankers sailing through the Strait of Hormuz?

It is impossible to choose sides in the Middle East. For instance, ever since the 9/11 attack, the United States has considered al-Qaeda to be its prime adversary in the world. Yet last week, Americans found themselves on the same side as al-Qaeda in backing Saudi Arabia’s efforts to expel the Shi’ite Houthi rebels from Yemen. Yet at the very same time, we were negotiating a nuclear agreement with Iran that is widely perceived as supporting the Shi’ite faction in the Middle East, in defiance of Sunni Saudi Arabia. The Saudis have said they may seek a nuclear weapon themselves if Iran is able to secure one. Imagine a nuclear-armed Iran and Saudi Arabia facing each other across the Persian Gulf while our oil tankers try to escape into the Indian Ocean.

The only reasonable strategy here is to reduce our dependence on Persian Gulf oil. We still import 20 percent of our oil from the Persian Gulf, with 13 percent coming from Saudi Arabia. This is down from over 30 percent a decade ago, but we can still go further. America’s amazing improvement in oil production has played a part, but we are still dependent on oil for 80 percent of our transport sector. Substituting other kinds of fuels to power our vehicles is the obvious answer.

The Middle East tinder box isn’t going to go away during our lifetime. The obvious solution is to disassociate ourselves as much as possible. Freeing ourselves from our dependence on oil for our transport sector is the first and foremost step forward.

The Greeks are going broke…slowly! The Russians are bipolar with respect to Ukraine! Rudy Giuliani has asked the columnist Ann Landers (she was once a distant relative of the author) about the meaning of love! President Obama, understandably, finds more pleasure in the holes on a golf course than the deep political holes he must jump over in governing, given the absence of bipartisanship.

But there is good news! Many ethanol producers and advocacy groups, with enough love for America to encompass this past Valentine’s Day and the next (and of course, with concern for profits), have acknowledged that a vibrant, vigorous, loving market for E85 is possible, if E85 costs are at least 20 percent below E10 (regular gasoline) — a percentage necessary to accommodate the fact that E10 gas gets more mileage per gallon than E85. Consumers may soon have a choice at more than a few pumps.

But there is good news! Many ethanol producers and advocacy groups, with enough love for America to encompass this past Valentine’s Day and the next (and of course, with concern for profits), have acknowledged that a vibrant, vigorous, loving market for E85 is possible, if E85 costs are at least 20 percent below E10 (regular gasoline) — a percentage necessary to accommodate the fact that E10 gas gets more mileage per gallon than E85. Consumers may soon have a choice at more than a few pumps.

In recent years, the E85 supply chain has been able to come close, in many states, to a competitive cost differential with respect to E10. Indeed, in some states, particularly states with an abundance of corn (for now, ethanol’s principal feedstock), have come close to or exceeded market-based required price differentials. Current low gas prices resulting from the decline of oil costs per barrel have thrown price comparisons between E85 and E10 through a bit of a loop. But the likelihood is that oil and gasoline prices will rise over the next year or two because of cutbacks in the rate of growth of production, tension in the Middle East, growth of consumer demand and changes in currency value. Assuming supply and demand factors follow historical patterns and government policies concerning, the use of RNS credits and blending requirements regarding ethanol are not changed significantly, E85 should become more competitive on paper at least pricewise with gasoline.

Ah! But life is not always easy for diverse ethanol fuel providers — particularly those who yearn to increase production so E85 can go head-to-head with E10 gasoline. Maybe we can help them.

Psychiatrists, sociologists and poll purveyors have not yet subjected us to their profound articles concerning the possible effect of low gas prices on consumers, particularly low-income consumers. Maybe, just maybe, a first-time, large grass-roots consumer-based group composed of citizens who love America will arise from the good vibes and better household budgets caused by lower gas prices. Maybe, just maybe, they will ask continuous questions of their congresspersons, who also love America, querying why fuel prices have to return to the old gasoline-based normal. Similarly, aided by their friendly and smart economists, maybe, just maybe, they will be able to provide data and analysis to show that if alternative lower-cost based fuels compete on an even playing field with gasoline and substitute for gasoline in increasing amounts, fuel prices at the pump will likely reflect a new lower-cost based normal favorable to consumers. It’s time to recognize that weakening the oil industry’s monopolistic conditions now governing the fuel market would go a long way toward facilitating competition and lowering prices for both gasoline and alternative fuels. It, along with some certainty concerning the future of the renewable fuels program, would also stimulate investor interest in sorely needed new fuel stations that would facilitate easier consumer access to ethanol.

Who is for an effective Open Fuel Standard Program? People who love America! It’s the American way! Competition, not greed, is good! Given the oil industry’s ability to significantly influence, if not dominate, the fuel market, it isn’t fair (and maybe even legal) for oil companies to legally require franchisees to sell only their brand of gasoline at the pump or to put onerous requirements on the franchisees should they want to add an E85 pump or even an electric charger. It is also not right (or likely legal) for an oil company and or franchisee to put an arbitrarily high price on E85 in order to drive (excuse the pun) consumers to lower priced gasoline?

Although price is the key barrier, now affecting the competition between E85 and E10, it is not the only one. In this context, ethanol’s supply chain participants, including corn growers, and (hopefully soon) natural gas providers, need to review alternate, efficient and cost-effective ways to produce, blend, distribute and sell their product. More integration, cognizant of competitive price points and consistent with present laws and regulations, including environmental laws and regulations, is important.

The ethanol industry and its supporters have done only a fair to middling job of responding to the oil folks and their supporters who claim that E15 will hurt automobile engines and E85 may negatively affect newer FFVs and older internal combustion engines converted to FFVs. Further, their marketing programs and the marketing programs of flex-fuel advocates have not focused clearly on the benefits of ethanol beyond price. Ethanol is not a perfect fuel but, on most public policy scales, it is better than gasoline. It reflects environmental, economic and security benefits, such as reduced pollutants and GHG emissions, reduced dependency on foreign oil and increased job potential. They are worth touting in a well-thought-out, comprehensive marketing initiative, without the need to use hyperbole.

America and Americans have done well when monopolistic conditions in industrial sectors have lessened or have been ended by law or practice (e.g., food, airlines, communication, etc.). If you love America, don’t leave the transportation and fuel sector to the whims and opportunity costing of the oil industry.

While they might not make the Late Show with David Letterman, here are ten reasons why the fall in oil and gas prices, if it is sustained for a while, is, on balance, good for the U.S. and replacement fuels.

We haven’t reached fuel Nirvana. The differential between gasoline and corn-based E85 has lessened in most areas of the nation and now appears less than the 20-23 percent needed to get consumers to think about switching to alternative fuels like E85. But cheaper replacement fuels appear on the horizon (e.g., natural gas-based ethanol) and competition in the supply chain likely will reduce their prices. Significantly, in terms of alternative replacement fuels, oil and gas prices are likely to increase relatively soon, because of: continuing tensions in the Middle East, a change of heart on the part of the Saudis concerning maintaining low prices, the increased cost of drilling for tight oil and slow improvements in the U.S. economy resulting in increased demand. The recent decline in hybrid, plug-in and electric car sales in the U.S. follows historical patterns. Cheap gas or perceived cheap gas causes some Americans to switch to larger vehicles (e.g., SUVs) and, understandably, for some, to temporarily forget environmental objectives. But, paraphrasing and editing Gov. Schwarzenegger’s admonition or warning in one of his films, unfortunately high gas prices “will be back…” and early responders to the decline of gasoline prices may end up with hard-to-sell, older, gas-guzzling dinosaurs — unless, of course, they are flex-fuel vehicles.

I began what turned out to be a highly ranked leadership program for public officials at the University of Colorado in the early ’80s, as dean of the Graduate School of Public Affairs. I did the same for private-sector folks when I moved to Irvine, Calif., to run a leadership program involving Israeli startup CEOs for the Merage Foundations. Despite the different profiles of participants, one of the compelling themes that seemed pervasive to both — for- profits in Israel and governments everywhere — was and remains building the capacity of leaders to give brief, focused oral presentations or elevator pitches (or, as one presenter once said, “how to seduce someone between the first and fifth floor”). A seduction lesson in oil economics in a thousand words or three minutes’ reading time!

Now that I got your attention! Sex always does it! During the last few days, I read some straightforward, short, informative articles on oil company and environmentalist group perceptions concerning the relationship between the price of oil per barrel and the cost of drilling. Their respective pieces could be converted into simple written or oral elevator pitches that provided strategic background information to the public and political leaders — information often not found in the news media — press, television, cable and social media — concerning oil company or environmentalist decision-making.

This is good news. Most of the academic and, until recently, media coverage of the decline of oil and gasoline prices generally focuses on the dollar or percentage drop in the price of oil and gasoline from a precise date … 3 months, 6 months, a year, many years ago, etc. And, at least by implication in many of its stories, writers assume decision-making is premised on uniform costs of drilling.

But recently, several brief articles in The Wall Street Journal, MarketWatch, OilPrice.com, etc., made it clear that the cost of drilling is not uniform. For example, there is a large variation internal to some countries depending on location and geography and an often larger variation between and among oil-producing nations. Oil hovers around $80 a barrel now, but the cost of drilling varies considerably. In Saudi Arabia, it is $30 per barrel or less on average; in the Arctic, $78; in Canada’s oil sands $74; and in the U.S, $62.

If you’re responsible for an oil company or oil nation budget, a positive cash flow and a profit, you are likely to be concerned by increasingly unfavorable opportunity cost concerning costs of drilling and returns per barrel. In light of current and possibly even lower prices, both companies and nations might begin to think about the following options: cutting back on production and waiting out the decline, pushing to expand oil exports by lowering costs in the hopes of getting a better than domestic price and/or higher market share, lessening your investment in oil and moving toward a more balanced portfolio by producing alternative fuels. If you believe the present price decline is temporary, and that technology will improve drilling cost/price per barrel ratios, you might consider continuing to explore developing wells.

Up to now, the Saudis have acted somewhat counterintuitively. They have created dual prices. Overall, they have sustained relatively high levels of production. For America, they have lowered prices to hold onto or build market share and undercut prices related to U.S. oil shale. For Asia, they have increased prices, hoping that demand, primarily from China and India, and solid production levels in the Kingdom, will not result in a visible drop in market share.

However, the Saudis know that oil revenue has to meet budget needs, including social welfare requirements resulting in part from the Arab Spring. How long they can hold onto lower prices is, in part, an internal political and budget issue, since oil provides a disproportionate share of the country’s public revenue. But, unlike the U.S. and many other nations, where drilling for tight oil is expensive, the Saudis have favorable ratio between production costs and the price of oil. Again, remember the cost of production in the U.S., on average, is about 100 percent above what it is in Saudi Arabia and some other OPEC nations. Deserts may not provide a “wow” place for all Middle East residents or some tourists looking for a place to relax and admire diverse landscapes, but, at the present time, they provide a source of relatively cheap oil. Further, they permit OPEC and the Saudis to play a more important global role in setting prices of oil and its derivative gasoline than their population numbers and their nonoil resources would predict. Lowering prices and keeping production relatively high in the Middle East is probably good for the world’s consumers. But as environmentalists have noted , both could slow oil shale development in the U.S. and with it the slowdown of fracking. Both could also interest oil companies in development of alternative fuels.

Oil-rich nations in the Middle East and OPEC, which control production, will soon think about whether to lower production to sustain revenues. In the next few months, I suspect they will decide to risk losing market share and increase per barrel oil prices. U.S policy and programs should be recalibrated to end the nation’s and West’s often metabolic response to what the Saudis do or what OPEC does. Support for alternative replacement fuels is warranted and will reduce consumer costs over the long haul and help the environment. It will also decrease America’s dependence on Middle East oil and reduce the need to “think” war as a necessary option when developing America’s foreign policy concerning the Middle East.

“It’s a puzzlement,” said the King to Anna in “The King and I,” one of my favorite musicals, particularly when Yul Brynner was the King. It is reasonable to assume, in light of the lack of agreement among experts, that the Chief Economic Adviser to President Obama and the head of the Federal Reserve Bank could well copy the King’s frustrated words when asked by the president to interpret the impact that the fall in oil and gasoline prices has on “weaning the nation from oil” and on the U.S. economy. It certainly is a puzzlement!

What we believe now may not be what we know or think we know in even the near future. In this context, experts are sometimes those who opine about economic measurements the day after they happen. When they make predictions or guesses about the behavior and likely cause and effect relationships about the future economy, past experience suggests they risk significant errors and the loss or downgrading of their reputations. As Walter Cronkite used to say, “And that’s the way it is” and will be (my addition).

So here is the way it is and might be:

1. The GDP grew at a healthy rate of 3.5 percent in the third quarter, related in part to increased government spending (mostly military), the reduction of imports (including oil) and the growth of net exports and a modest increase in consumer spending.

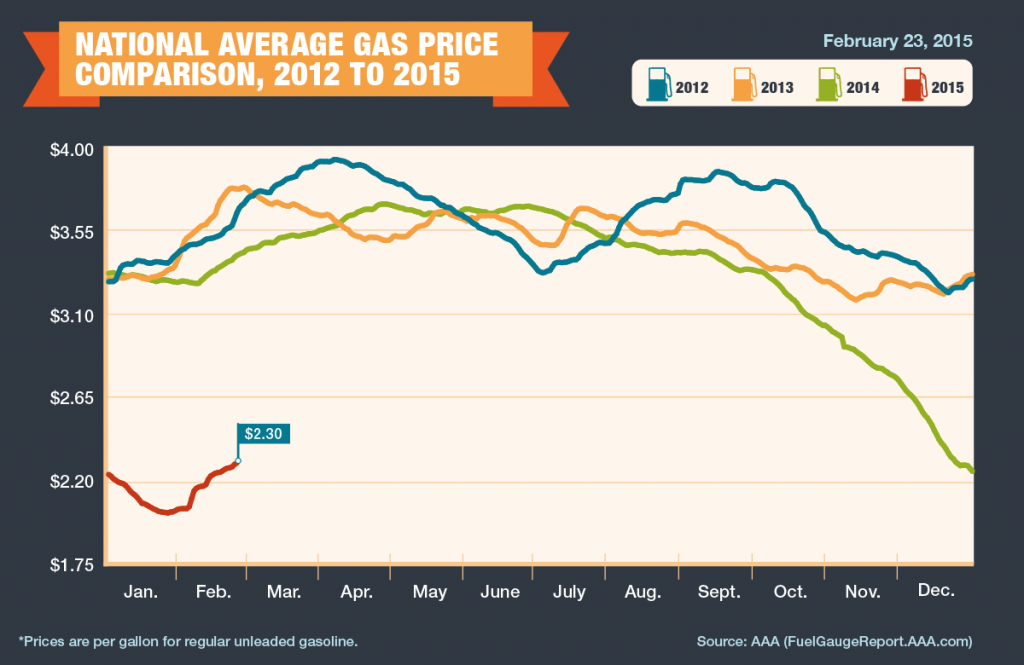

2. Gasoline prices per gallon at the pump and per barrel oil prices have trended downward significantly. Gasoline now hovers just below $3 a gallon, the lowest price in four years. Oil prices average around $80 a barrel, decreasing by near 25 percent since June. The decline in prices of both gasoline and oil reflects the glut of oil worldwide, increased U.S. oil production, falling demand for gasoline and oil, and the likely desire of exporting nations (particularly in the Middle East) to protect global market share.

Okay, what do these numbers add up to? I don’t know precisely and neither do many so-called experts. Some have indicated that oil and gas prices at the pump will continue to fall to well under $80 per barrel, generating a decline in the production of new wells because of an increasingly unfavorable balance between costs of drilling and price of gasoline. They don’t see pressure on the demand side coming soon as EU nations and China’s economies either stagnate or slow down considerably and U.S. economic growth stays below 3 percent annually.

Other experts (do you get a diploma for being an expert?), indicate that gas and oil prices will increase soon. They assume increased tension in the Middle East, the continued friction between the West and Russia, the change of heart of the Saudis as well as OPEC concerning support of policies to limit production (from no support at the present time, to support) and a more robust U.S. economy combined with a relaxation of exports as well as improved consumer demand for gasoline,

Nothing, as the old adage suggests, is certain but death and taxes. Knowledge of economic trends and correlations combined with assumptions concerning cause and effect relationships rarely add up to much beyond clairvoyance with respect to predictions. Even Nostradamus had his problems.

If I had to place a bet I would tilt toward gas and oil prices rising again relatively soon, but it is only a tilt and I wouldn’t put a lot of money on the table. I do believe the Saudis and OPEC will move to put a cap on production and try to increase prices in the relatively near future. They plainly need the revenue. They will risk losing market share. Russia’s oil production will move downward because of lack of drilling materials and capital generated by western sanctions. The U.S. economy has shown resilience and growth…perhaps not as robust as we would like, but growth just the same. While current low gas prices may temporarily impede sales of electric cars and replacement fuels, the future for replacement fuels, such as ethanol, in general looks reasonable, if the gap between gas prices and E85 remains over 20 percent — a percentage that will lead to increased use of E85. Estimates of larger cost differentials between electric cars, natural gas and cellulosic-based ethanol based on technological innovations and gasoline suggest an extremely competitive fuel market with larger market shares allocated to gasoline alternatives. This outcome depends on the weakening or end of monopolistic oil company franchise agreements limiting the sale of replacement fuels, capital investment in blenders and infrastructure and cheaper production and distribution costs for replacement fuels. Competition, if my tilt is correct, will offer lower fuel prices to consumers, and probably lend a degree of stability to fuel markets as well as provide a cleaner environment with less greenhouse gas emissions. It will buy time until renewables provide a significant percentage of in-use automobiles and overall demand.

Calling Miss Moneypenny…we need you to get to James Bond quickly. Urgently! According to respected sources, there is a conspiracy in place on the part of the U.S. government and the West to both foster the increased production of shale gas and to drive down demand for gasoline in order to decrease Middle Eastern and Russian oil prices to levels well below production and distribution costs. The effort is aimed at breaking up OPEC, keeping the Saudis in line regarding present levels of production and hurting Russia until it comes to its senses concerning Ukraine. Can you put me in touch with Bond? He could be helpful in determining whether there is manipulation of the market? He’s just the best!

Paranoia has set in on the part of some in the media. The “glut” of oil on the market and low demand has made new drilling an “iffy” thing. The production costs of oil per barrel have not kept pace with revenue from sales. Prices at the pump for gasoline have decreased significantly.

How can we explain the phenomena, except by the presence of manipulation? Indeed, it’s enlightening to see (assumedly) planned, tough, provocative statements from so-called experts that often make headlines followed by weak “No it cannot be true” statements by the same experts to protect their credentials. Being bipolar is, in these instances, seemingly a characteristic.

Thanks to CNBC, here are some summary comments.

Patrick Legland, head of global research at Société Générale, recently said that it was an interesting coincidence that the two events — a drop in oil prices and lower demand — suggests that the U.S. could be deliberately manipulating the market to hurt Russia. Is it lower demand or is the U.S. clearly maneuvering? Legland goes on to indicate lack of in-depth knowledge. Timothy Ash, head of emerging markets research at Standard Bank suggested the U.S. would obviously deny any accusations of manipulation and there is no evidence to suggest that this is the case. “It’s very had to prove. I have heard such suggestions before. It is clearly useful for the West as it adds pressure on Russia” (and, I would add, on OPEC).

Oh, there is more, Jim Rickerts, managing director at Tangent, in a courageous and clear-cut example of ambiguity, stated that manipulation is plausible, although we have no evidence.

Clearly, the manipulation assertions, even though there is little evidence, sell more papers, build a bigger audience for cable news and provide fodder for Twitter and politicians. To the tune of “Politics and Polka,” sing with me, “apparent correlation is not causation, correlation is not causation.”

Oil prices are on a downward spiral, while production and distribution costs are going up in the U.S. and much of the West. It is implausible that the government is behind these trends. Consumer demand is down, even with lower prices at the pump, because of the economy. The government has relatively few tools, except the public and private bully pulpit in the short term, to leverage prices. The current boom in oil shale and resulting surpluses result from decisions made by an extended group of people often years ago — for example, oil companies who recognized that the era of easy-to-drill and cheap oil was coming to an end, speculators who led the market in trumping the benefits in investing long in oil shale and waiting for assumed value to catch up, consumers who seemed to be on a high concerning use of gasoline and technological breakthroughs that made oil from shale seem more amendable to cost benefit calculations.

While there are examples of government manipulating prices of goods (e.g., price controls), most have led to unpredictable and often negative results. The U.S. government, whether controlled by Republicans or Democrats, has not shown itself adept at price setting and manipulation. Nor is it good at keeping things secret — something necessary if it engaged in international manipulation. The New York Times would already have a leaked copy of the strategy and unsigned emails would have been given to the Washington Post. Public discussion of the strategy probably would risk sometimes fake, sometimes real approbation-depending who gets hurt or will get hurt. The U.S. would face copycats, as they have in the past, like the Saudis and OPEC and, maybe someday, Russia. They would say, “well, if the U.S. can do it, why can’t we?” The U.S. would calmly respond, No we are not manipulating oil markets. You give us too much credit and assume to many skills. Also, remember, the U.S and the oil companies believe in free markets. Don’t they? Well maybe, but clearly, not all the time with respect to the government and almost none of the time with respect to the oil companies? (Try getting replacement fuels at the pump of an oil-company franchised “gas” station.)

Okay, Miss Moneypenny, I changed my mind. We don’t need James Bond nor do we want to pay for the Bond girls. (Besides, the last Bond looked like President Putin when his shirt was unbuttoned and Sean Connery is on Medicare.) What we need is prayer and penitence for the experts for travailing in rumors. It is not terribly helpful when trying to sort out complicated issues related to oil prices and demand. If the government is somehow manipulating the market, many, even very pro-market advocates, will give it credit for a strategy that, should it be successful, might limit Russia’s desires concerning Ukraine and OPEC’s efforts at price fixing in the past. While the word has an evil sound, perhaps legitimately, manipulation would likely be judged better than war. But before credit is offered, look at the data and well-reviewed studies. Don’t fret, there is very little evidence that government manipulation has occurred in the recent past or is occurring at the present time.

Bloomberg has an interesting story about one way Israel intends to improve relations with its critics in the Middle East: Enter into deals to sell some of its vast stores of natural gas to neighboring countries.

Israel has more patents per capita than any other nation in the world. Despite wars and tension at its borders, international investor interest remains high, particularly in high-tech industries. Indeed, high-tech industries continue to grow faster than any other industrial sector.

Okay. I have a serious question for questioning minds. The Jerusalem Post stated that pollution levels dropped by 99 percent on Saturday, Yom Kippur, a key Jewish religious holiday. The article indicated that nitrogen oxides decreased by 99 percent in the Gush Dan and Jerusalem regions and that other serious pollutants that affect health and well-being also dropped significantly. (Truth in advertising compels me to say that Israel has another holiday called Lag B’omer, where folks light bonfires to celebrate a wise sage in Israel’s past. Many also travel to the sage’s tomb. Both activities make air quality terrible. But understanding, apology, patience and penitence may result yet in friendlier environmental options.)

Wow, could Israel patent environmental behavior based in religion to secure a healthy environment? What would they patent? Perhaps, activities resulting from seeking forgiveness for previous driving and fuel related sins generating harmful pollutants. Asking forgiveness and apologizing are what Jews are supposed to do on the Holy Day. Or should they try patenting the environmental God, Himself or Herself, to make sure we have a major partner with respect to minimizing pollution in the environment. Here, they could include other possible partners like the scientists busy at work in Switzerland on the “God particle” in their patent.

Maybe Israel’s success with Yom Kippur behavior would lead Catholics, Protestants, Muslims, Hindus and Mormons to define and patent Holy No Drive Days or better yet, because of lessons learned from Israel and possible Israeli involvement, lengthier environmental behavior days, weeks, months or years. Because of the negative impact on the global economy, international security and the environment of the world’s present dependency on oil and oil’s derivative gasoline, perhaps all the major religions and even the minor ones could agree on a range of environmentally friendly behavior changing initiatives, particularly related to one of the largest pollutants of them all…oil. Each patent would be based on prescriptions written or derived from religious interpretation of each religion’s environmental norms and tenants and holidays. Here’s one: Just say no to gasoline and yes to use of replacement fuels. Tithings from believers or congregants would support the effort. Figure it out, enough long holidays and the world might begin to reduce levels of pollution and likely GHG emissions, as well as oil-based wars and tension. Maybe we could develop a whole set of religious patents, that once patented, would be capable of being used by any nation or religion and any group or individual free. You know, building good, Godly behavior.

No government subsidies, no new government regulations. If behavioral changes stick, based on religious initiatives, our grandchildren and their grandchildren could live in a better world. While, likely impossible and the idea of patenting good behavior is more humorous than real, the thought seems worthy of a prayer or two and lots of meaningful sermons as well as interfaith action.

Collaboration by churches, synagogues and mosques could influence governments to jump in and also play a leadership role. Clearly, religiously inspired guilt is often aspirational and motivational — sometimes politically. Combined with religiously inspired individual commitment concerning grassroots activity, it could secure secular support for the development and implementation of comprehensive fuel policies concerning environmental, security and economic objectives — like social justice.

Where might we go with this? Probably not very far. But think of it. We spend much time arguing about God, and often much less time achieving godliness through reforming institutional and our behaviors as good stewards of the world. If we could marshal (excuse the pun), the leaders of some of the major religions of the world to help reduce harmful pollution from gasoline, GHG emissions and wars related to oil, over time, amendments to individual and group activities could help “convert” the bleak forecasts concerning climate change and increasingly dirty air for the better. Additionally, such an effort could also lead to a reduction of tension in areas like the Middle East, and global and national economic growth based on the development and distribution of both transitional replacement and renewable fuels.

I don’t expect invitations to discuss the matter from religious forums or meetings. But seeking collaboration from the religious community to end dependence on oil is something to think about in terms of the “what ifs.” Maybe in this context, a respected celebrated religious leader like Pope Francis could be asked to try to bring together religious leaders and even some secular ones to at least begin to discuss initiatives across man- or women-made national boundaries.

The proposed agenda would link short-term coordinated strategies to use transitional replacement fuels such as natural gas, ethanol, methanol and biofuels with longer-term plans (with immediate efforts) to increase the competitiveness of electric and hydro fuels. For my religious colleagues and secular friends, it seems to me that beginning these discussions is a moral and practical imperative.

The “Old Gray Lady,” The New York Times, did it again….its recent article indicating the extent of government funds from foreign countries supporting so-called independent think tanks and universities in the U.S. was enlightening and was also clearly in the public interest. Most of us policy wonks suspected or knew what the Times indicated on September 7. “More than a dozen prominent Washington research groups have received tens of millions of dollars from foreign governments in recent years while pushing United States government officials to adopt policies that often reflect the donors’ priorities…” The money is transforming the once-staid, think-tank world into a muscular arm of foreign government’s lobbying in Washington. And it has set off troubling questions about intellectual freedom — some scholars say they have been pressured to reach conclusions friendly to the government that is financing the research.” In this context, NATO, European, Middle East and Asian nations (e.g., Norway, Germany, Qatar, Saudi Arabia, United Arab Emirates, Japan, etc.) have been visible funders according to the Times and other media..

Before readers become holier than thou about the perception of perversion in foreign governments that link their support to what they want done regarding research and lobbying (implicit, if not explicit), they should know that the grant system in the U.S., in general, is not free of, at times, donor efforts to influence and/or sometimes pressure, whether it involves foreign governments, all levels of government in the U.S, business or foundation grants. Both have been and will remain the way of doing business.

I suspect attempts to influence or pressure research institutions or scholars are sometimes worse in social science research than in the sciences or engineering, where data, analysis and results can often claim at least some visible and quantifiable correlation or causation relationships. A donor’s ideological commitments also may predetermine and lessen the need for donors to try to negotiate the outcomes of grants or gifts. Not many liberal academics will apply for research money from the Koch Family Foundations, not many conservatives will likely go to the George Soros Open Society Foundations (OSF) for money.

Life is complicated for donors and recipients. Free speech and the free flow of ideas are embedded in the U.S. creed and the nation’s constitution. Truth in advertising in research grants and their products, a mythological spin-off, is often muted by the overwhelming influence and importance of money and the need for it, in light of fund shortages. However, the American public, for the most part, cannot easily separate the respected status of the Brookings Institution, the University of California, the Center For Global Development, the Center for Strategic and International Studies, etc. from their willingness to accept what seem clearly donor advocacy grants and subsequently to participate in what appears, to many, to be advocacy research and lobbying. The involved leaders, not always the researchers, of recipient institutions will deny the fact that research money sometimes comes with a price concerning legal, moral and often spoken words in grantor testimonials or contracts concerning obligations to search for the truth and increase wisdom concerning policy and program options.

Oil and oil-related companies and Middle Eastern nations seem now to be among the biggest givers and perhaps receive the biggest “take back” benefits. They fund schools and centers as well as analyses in and at major universities and independent think tanks, both within and outside universities. They have also funded “independent” scholars, chairs and specific RFPs (Request for Proposals) describing general and sometimes relatively specific areas of energy or transportation and fuel-related research. Significant oil and foreign money for policy-related research is also funded through third-party groups, which often mask the source of donations. Donors, understandably, expect benefits from supported research — at least consistency with and, in some cases, advocacy for their economic, social welfare and environmental objectives.

Perhaps one of the more egregious relationships concerning policy or program research involved the Coordinating Research Council (CRC), generally a mouthpiece of and also funded by the oil and automotive industry. Its relatively recent study debunking of E15 reflected the views of their sponsors — again the oil and auto industries. It indicated that E15 significantly harmed engines of many vehicle classes. The study was legitimately criticized by the EPA and others concerning methodology and content. Indeed, it and its implications concerning use of E15, was refuted in part or whole by the EPA’s more extensive analyses, by the National Renewable Energy Laboratory (NREL) and by other respected groups and individuals, some even associated with the auto industry. CRC’s efforts stimulated analyses and similar findings by groups like AAA— again based on even weaker methodology and unknown funding (likely mostly membership dues). Critics have pointed to AAA’s tenuous policy links to members and its long-time support by and of the auto and oil industries. Remember, more cars result in more gasoline use and increased ownership secures more AAA memberships.

Forget the legitimacy or illegitimacy of the proponents and critics of research concerning E15, or for that matter E85. At most times, policy choices and behavior are not based on perfection concerning data and analysis.

What concerns me the most is the predominance of oil and its friends’ money and the lack of transparency concerning funding sources and grant and gift requirements or constraints — both informal and formal.

Like the Times, I am also concerned about the dividing line between education and lobbying concerning grants and gifts provided by oil companies and, foreign nations. Lobbyists are required to register as such. Most think tanks and universities do not see themselves as lobbyists and do not register.

Industry, some foundation and even government-supported research grants sometime come with strings attached. Even if they didn’t, the results of paid research into complex issues are generally not conclusive and can be helpful in stimulating dialogue, if it’s matched by research initiatives funded by donors with different perceptions. Bad, or mediocre research funded by advocates, like speech, shouldn’t be countered by censorship, but by efforts to execute better research and by initiatives to provide to policymakers and the public with countervailing views and analysis to generate dialogue and debate.

I am not a purist. There is no chance in hell that the basic system of what I call advocacy grants and gifts now in existence will end. But public policymakers should insist on transparency as to funding sources and research methodology. Key advocacy studies likely to affect public sentiment and decision maker views concerning replacement fuels and gasoline should be granted, at least some form of even informal refereed reviews. If I could figure out an easy way to do it, I would define alternatives that would provide some reasonable equivalency concerning research funding. They would assure Americans that all key replacement fuel options are examined fully and are compared to gasoline. The research on replacement fuels should not be submerged by foreign nation or internal U.S. oil interest funding. But I don’t get paid enough nor am I smart enough to think this one through, at least until the next column. Maybe you can help me? Paraphrasing my favorite oil scholar, Socrates, unexamined studies funded without independent review, only by the oil industry or its Middle East friends and colleagues, are often not worth having or debating. Peace.