The battle lines already are drawn over the Environmental Protection Agency’s announcement Wednesday that it’s seeking to reduce the nation’s levels of ground-level ozone, the main component of smog.

Under the Clean Air Act, the EPA is required to review air-quality standards every five years. Under President George W. Bush, the agency set the ozone threshold at 75 parts per billion in 2008.

The EPA now wants to lower the bar to between 65 ppb and 70 ppb, the level that the agency’s advisory board of independent scientists and physicians has recommended. However, EPA will review comments on a lower benchmark of 60 ppb during its commentary period.

Ozone is created when sunlight hits emissions coming from vehicles, electricity-generating plants and factories. The EPA said ozone at the current accepted levels “can pose serious threats to public health, harm the respiratory system, cause or aggravate asthma and other lung diseases, and is linked to premature death from respiratory and cardiovascular causes.”

The NRDC said medical evidence shows that the revised limit, even at the lower end of 65 ppb, is harmful to health. ”So we urge EPA to set the standard at 60 ppb.”

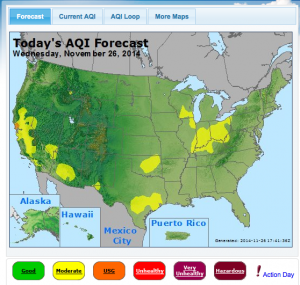

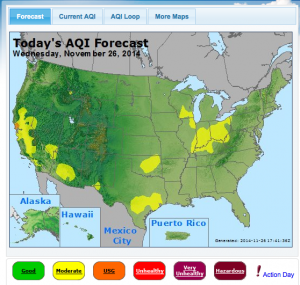

(Click on the image at right to check the national Air Quality Index.)

(Click on the image at right to check the national Air Quality Index.)

That stance will put the EPA on a collision course with the manufacturing sector and Republican elected officials, who will control both the Senate and House in January. Sen. James Inhofe, the Oklahoma Republican who will take over as chairman of the Senate Environment and Public Works Committee, said in a statement that the lower threshold “will lower our nation’s economic competitiveness and stifle job creation for decades.”

National Association of Manufacturers president and CEO Jay Timmons said the new ozone regulation “threatens to be the most expensive ever imposed on industry in America and could jeopardize recent progress in manufacturing by placing massive new costs on manufacturers and closing off counties and states to new business …”

The Associated Press notes that the EPA initially proposed a range of 60 to 70 ppb in January 2010. Had that gone into effect, it would have come with an estimated price tag of between $19 billion and $90 billion and would have doubled the number of U.S. counties in violation.

In 2011, President Obama, in advance of his 2012 re-election campaign, “reneged on a plan by then-Environmental Protection Agency administrator Lisa Jackson to lower the permissible level to be more protective of public health,” The AP wrote.

“Seldom do presidents get an opportunity to right a wrong,” Bill Becker of the National Association of Clean Air Agencies told AP. “Obama has walked the walk on air.”

Current EPA administrator Gina McCarthy, in a post on CNNMoney.com, put the health argument front and center. But she also said cutting emissions would help the economy, not hinder it:

“Missing work, feeling ill, or caring for a sick child costs us time, money, and personal hardship. When family health issues hurt us financially, that drags down the whole economy. … Special-interest critics will try to convince you that pollution standards chase away local jobs and businesses, but, in fact, healthy communities attract new businesses, new investment, and new jobs.”